Mike's tax emporium

tax consulting

Welcome to Mike’s Tax Emporium.

Over the years, personal taxation has become increasingly complicated. Whether you are letting a property, running a self-employed business, working, or serving in the MOD, the pathway through personal taxation is often full of challenges.I take pride in offering clear, personal tax advice to individuals from all walks of life. If your situation falls outside my area of expertise, I will let you know and signpost you to an appropriate adviser.For those I can support, I provide a transparent, straightforward tax planning process and can assist with Capital Gains Tax (CGT), Inheritance Tax (IHT), as well as your annual self-assessment tax return. Please feel free to contact me for a free, no-obligation discussion about your personal circumstances.

I look forward to hearing from you! Mike

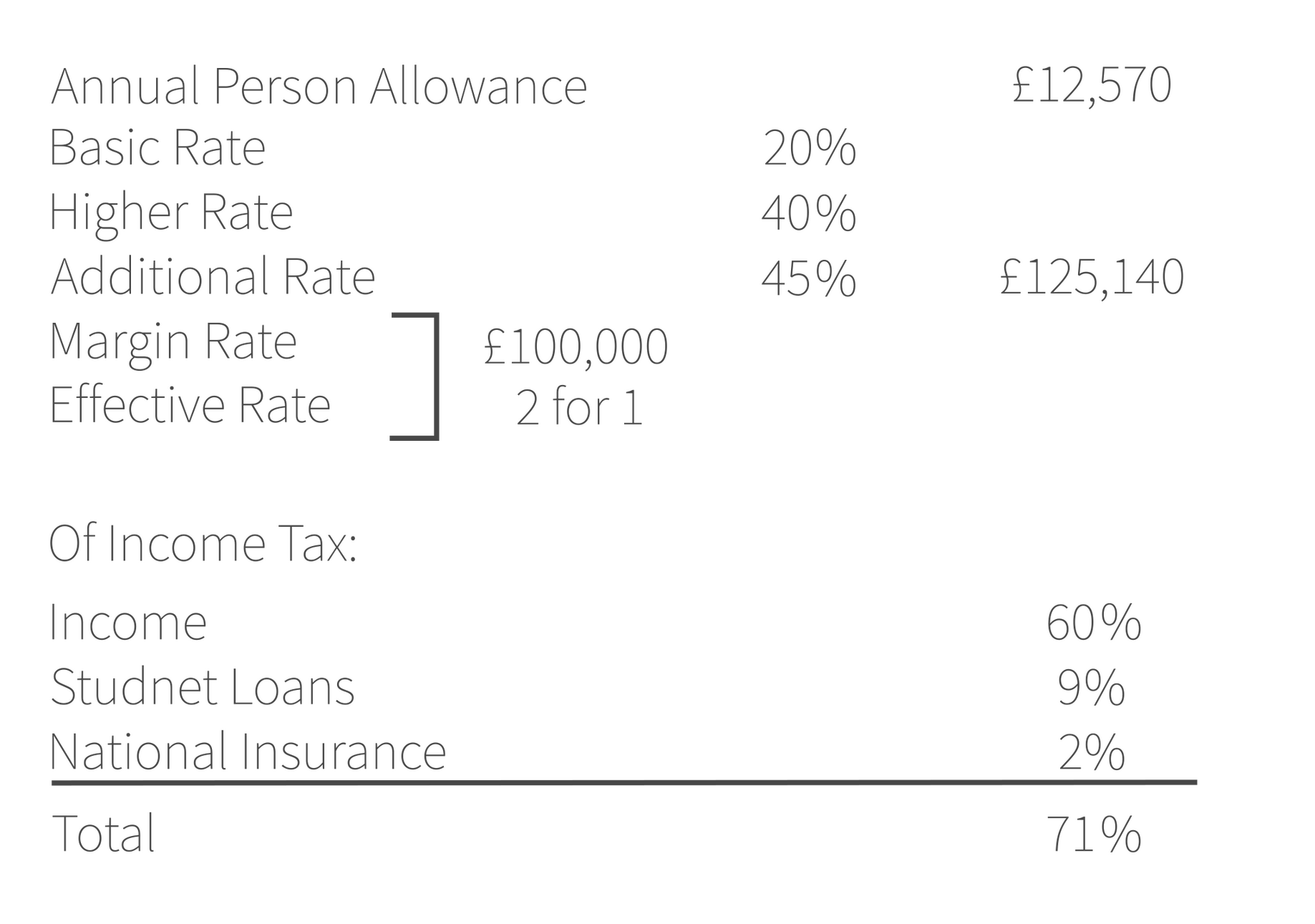

INCOME TAX

As a U.K. Resident you are entitled to earn up to £12,570 free of income tax annually. This changes if you are fortunate enough to earn over £100,000 annually.Once you earn £12,571 you will pay income tax at the basic rate of 20%. This will normally be done through your employer’s payroll and is known as PAYE pay as you earn

How do you mitigate?

National Insurance

Who pays National Insurance?You pay mandatory National Insurance if you’re 16 or over and are either:• an employee earning more than £242 per week from one job• self-employed and making a profit of more than £12,570 a yearYou usually do not pay National Insurance, but may still qualify for certain benefits and the State Pension, if you’re either:• an employee earning from £125 to £242 a week from one job• self-employed and your profits are £6,845 or more a yearYour contributions are treated as having been paid to protect your National Insurance record.

When you stop payingIf you’re employed, you stop paying Class 1 National Insurance when you reach State Pension age.

If you’re self-employed you stop paying Class 4 National Insurance from 6 April (start of the tax year) after you reach State Pension age.

Child Benefit

If you have one child or more you are entitled to claim 'Child Benefit'from the Government.The current rates for 1 or more child/children are as follows:First or only child: £25.60 pw.Each additional child: £16.95 pw.It is always worth claiming Child Benefit but many family's will fall into the Child Benefit Tax Charge if one or both parents earn over £60,000.

This means that you will pay back the Child Benefit received either through your Tax Code (PAYE Coding) or through your Annual Self-Asssesment Tax Return.There's no right answer here, some would argue take the CB and save in an interest bearing account and then pay the tax back with the benefit of a few pounds interest. The other benefit is if you claim CB, you automatically gain National Insurance Credits!

Capital Gains Tax

Capital Gains Tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value.

It’s the gain you make that’s taxed, not the amount of money you receive. For example, if you bought a painting for £5,000 and sold it later for £25,000, you’ve made a gain of £20,000 (£25,000 minus £5,000).Some assets are tax-free. You also do not have to pay Capital Gains Tax if all your gains in a year are under your tax-free allowance.You pay Capital Gains Tax on the gain when you sell

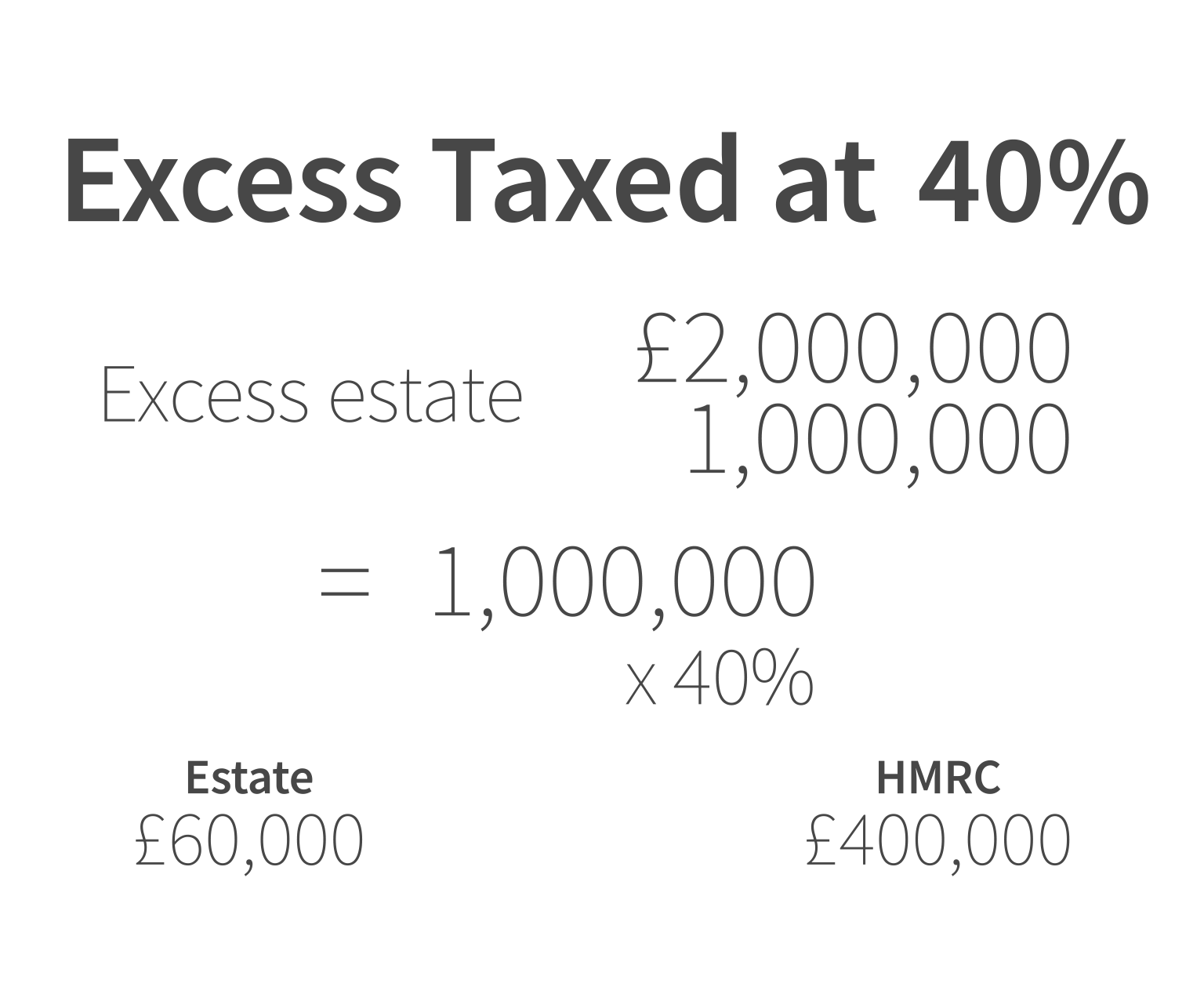

Inheritance Tax (IHT)

Mike to Complete

| Inheritance tax | allowance |

|---|---|

| Single Person | 325,000 |

| Primary Property | 175,000 |

| Total | 500,000 |

| Inheritance tax | allowance |

|---|---|

| Married Couple/Civil Partnership | 1,000,000 |

| Total | 1,000,000 |

IHT Mitigations

1 - One-off annual payment to friends and family £500 - No Maximum

2 - One-off lumpsum of £3,000 back dated for 1 year i.e £6,000

3- Wedding cost £2,000

4 - Gifting out of income i.e.

Must Keep Evidence!

In the tax year 2022 to 2023, 4.62% of UK deaths resulted in an Inheritance Tax (IHT) charge, increasing by 0.23 percentage points since the tax year 2021 to 2022. This means that IHT is payable on fewer than 1 in 20 estates, as it has been since 2007 to 2008, and broadly since statistics were first produced. This proportion is now equal to its previous 2016 to 2017 high.

About

Mike Tunstall - CEO

Mike joined the Royal Air Force in 1992 as an Air Traffic Controller. In 2000, he decided to specialise as an Air Operations Officer, during which he served at RAF Lyneham, RAF Leeming, and HQ Army, seconded to the Joint Helicopter Command.

During this period, he deployed on operations to the Falkland Islands, the Democratic Republic of Congo, Uganda, Cyprus, Iraq and Qatar.Promoted to Squadron Leader in 2006, he returned to Lyneham as Chief of Staff, Hercules Force Headquarters, and later deployed to Afghanistan in support of Operation Enduring Freedom.On returning, he specialised as a Requirements Officer at the Defence Equipment and Support based at MOD Abbeywood and was part of the Communication and Informations Systems Delivery Team.In 2010, he retired from full-time duty to pursue a career in Financial Planning, graduating as a Fellow of the Personal Finance Society in 2014. This coincided with becoming a volunteer reserve at RAF Brize.Between 2011 and 2019 he was a full-time househusband to his two children whilst also employed as a volunteer reserve with 622 Sqn and seconded to 47 Sqn where he worked closely with the full-time Operations Team, Crews and Executive Team.In 2020 he joined RAF eXperimental (RAFX) based at RAF Leeming where he still serves today.Mike enjoys time at the gym, cycling, swimming and playing golf poorly. He is a big F1 fan and hopes Lando Norris will win the World Championship in 2025. However, his passion is spending quality time with his partner and son.

Lewis Weatherill-Podbury - CTO

Amy Dixon - AdminAmy joined MTE Ltd in August 2025 on a part—time basis. Her previous roles include childcare assistant and a member of the ‘In Health’ Team where she specialised in the call centre team dealing directly with both patients and the Clinical Team to plan appointments for the NHS’s Lung Screening Scheme. Amy is delighted to be joining MTE Ltd and starting the training in pathway and with Mike’s guidance to becoming a Level 4 Para-Planner within the business.

Contact

Mr M S R Tunstall

Mike

73 Deepdale Ave

Teesside

TS18 2QEMobile: 07947 475445

Email: [email protected]

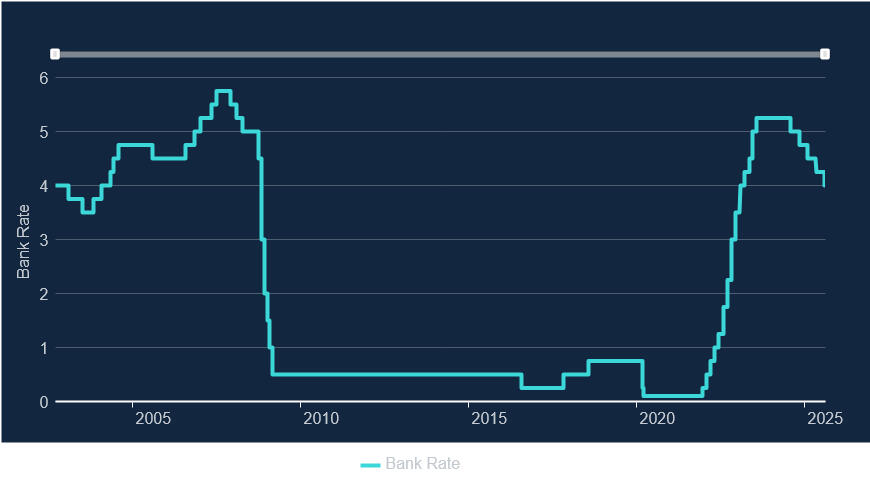

Bank of England and Base Rate

Interest rates in the UK are governed by the Bank of England with light touch oversight from HM Government - currently the Labour Party. The Government have mandated that the BoE aims for a rate of annual inflation of 2%. On 7 August 2025 the BoE monetary panel reduced Base Rate to 4.25% from 4.5% and although inflation is hovering around 3.5%, this is perhaps a sign that the Monetary Committee believe in the longer term that inflation will fall.

Why is this important to you and I?Base Rate is the level of interest the BoE pay UK retail banks to lodge our money with the BoE. Therefore, Base Rate is reflected in the amount of interest offered to savers and those that borrow in the form of mortgages, credit cards and loans.

| date changed | rate |

|---|---|

| 07 Aug 25 | 4.00 |

| 08 May 25 | 4.25 |

| 06 Feb 25 | 4.50 |

| 07 Nov 24 | 4.75 |

| 01 Aug 24 | 5.00 |

| 03 Aug 23 | 5.25 |

| 22 Jun 23 | 5.00 |

| 11 May 23 | 4.50 |

| 23 Mar 23 | 4.25 |

| 02 Feb 23 | 4.00 |

| 15 Dec 22 | 3.50 |

| 03 Nov 22 | 3.00 |

| 22 Sep 22 | 2.25 |

| 04 Aug 22 | 1.75 |

| 16 Jun 22 | 1.25 |

| 05 May 22 | 1.00 |

What Is The Budget Going To Mean To You?

It appears without doubt that Labour will break its manifesto promise and increase taxes on the working class. Whether you agree or disagree they haven’t got much choice. Public borrowing currently stands at 95.3% of GDP, its highest since 2020 and the pandemic. It’s a bitter pill to swallow but rather than tinker around the edges of possible tax hikes I feel we should bite the bullet and increase income tax by at least 1p in the pound, if not 2p. This will be the quickest way to increase revenues but at the same time public spending should be addressed particularly the cost of welfare.What will an increase to income tax mean for markets?Some have speculated that the FTSE All Share will suffer a loss but given that markets hate uncertainty but the Chancellor has already hinted at tax rises, I believe the markets are set for this outcome. There might be a minor, short term dip, but I believe that UK shares will not suffer any major downward trend.So what does this mean for you?We will all be hit with this increase. If you earn £100k PA, this will mean an increase of £749 in income tax.We’ll see if I’m correct on 26 November which also happens to be my Birthday!

A Week In Numbers

| Title | Author | Year | ISBN |

|---|---|---|---|

| 100 | 9147.81 | +18.1 | |

| All | 4460.59 | +7.49 | |

| Dow Ind | 44427.21 | +452.12 | |

| Nikkei | 897.69 | ||

| $ | 1.3487 | ||

| € | 1.1568 |

UK Jobs

Jobless 4.7% - four-year highPay Growth 5% - ↓ 4.6%One-off growth 5%Vacancy rate fell 44.000 ↓ 5%37th Consectutive fall, below pre-pandemic levels 718,000

The ONS said it's research 'suggests some firms may not be recruiting new workers or replacing workers who have left'.Rachel reeves conceded that the goverment had 'more to do' but defered her stewardship of the economy.

Making tax digital

Testimonials

John Cunningham - self employed tour manager

"Mike has been a trusted accountant for me for many years. He has an eye for attention to detail and makes sure all my financial affairs are in order in a timely fashion.I have no hesitation recommending him assisting with your personal tax affairs."

Charlotte and James

“Mike Tunstall has been advising and helping us with our tax for more than a decade. One of us is an executive in a global investment house, and one is a senior military officer — so we both have very different tax needs. But Mike is always able to help. He has always been helpful, accessible and efficient. We wouldn’t dream of using anyone else and we’re very happy to recommend him to anyone.“

Colin Laker - Wing Commander. RAF

“Mike Tunstall has been assisting me with my tax calculations, which have included my three rental properties, for many years. I have always been delighted by his work on, helping me calculate my tax, always making it easy and convenient for me to provide him with the right information, and as always, of course, saving me more money than I would have ever paid him if I had done it myself. A thoroughly nice chap, always easy to work with. Absolutely recommend him to all future customers.“